The reorganization of financial order worldwide

Two days of annual meetings at the World Bank and the International Monetary Fund (IMF) ended last week (October 7th) in Istanbul. The main focuses this time were to inject more funds into the World Bank and shift the specific ratio of voting rights from developed countries to developing ones inside the IMF. However, they did not reach a consensus on a number of issues which implied a shift of power within the organization.

The World Bank is not a bank in common sense. It is actually made up of two international development institutions, the IBRD (International Bank for Reconstruction and Development) and the IDA (International Development Association), which provide low-interest loans and grants to developing countries. The IMF is working to foster global monetary cooperation and international trade, while at the same time securing financial and monetary stability. Both of them were one of the three pillars of Bretton Woods system, and still survive today in the post-Bretton Woods era.

Even though the developed countries agree that the economy has not fully recovered yet and it is too early for governments to drop their stimulus programs now, they still have different opinions on boosting funding for the World Bank, not to mention demands by big developing countries for more voting power.

The shift in power can also be seen in the fact that the G20 summit is gradually replacing the G7’s function as the primary forum for international economic cooperation. The former includes big rich countries and emerging ones, but the later consist of rich countries only. As a matter of fact, the discussion of redistribution in voting power in the IMF followed conclusions made by the G20’s summit last month.

Such a power shift in international organization implies the influence of rich countries is not as strong as before and the emerging countries want a bigger say.

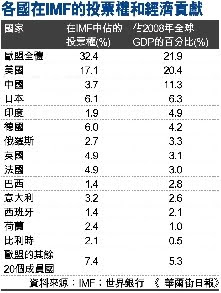

According to statistical data, the voting power in the IMF has trouble representing the real contributions of each country to global economic growth. Some rich countries are over-represented and some emerging countries like China and India are under-represented. In 2008, China accounted for 11.3% of global GDP growth but only got 3.1% of voting power in the IMF, and India contributed 4.9% to global GDP but only had 1.9% of the voting power in the IMF. They have therefore demanded that the European countries hand at least 5% of the voting power to them. Europeans appear supportive of this demand in principle, but in reality their position is very different.

Vested interests

As most international organizations were designed by the leading power at the time, institutional design is normally in line with the interests of this power. Therefore, the vested interests do not want to let go of the power in their hand when a new power is rising. So, how former leading powers accommodate themselves to the rise of these emerging countries may be the primary challenge facing these international organizations.

接連兩天在伊斯坦堡舉辦的世界銀行與國際貨幣組織年會於上週結束,討論的焦點則圍繞在是否挹注更多的資金給予世界銀行,以及如何從已開發國家轉移部分國際貨幣組織的投票權給予發展中國家。但關於這點,會議中並沒有產生太多共識,因為IMF內部任何的改變都將會造成權力的重組。

世界銀行並不是我們一般認為的銀行,它事實上是由兩個國際發展機構IBRD(國際復興開發銀行)與IDA(國際開發協會)所組成,他們主要的功能在於提供發展中國家低利率的貸款以及資金援助。而國際貨幣組織則負責促進全球貨幣與貿易合作,同時確保全球金融與貨幣的穩定。他們兩者都是形塑今日全球金融秩序的布列敦森林體系三大支柱之一。

儘管大家都同意全球經濟尚未完全復甦,且現在對於各國政府結束各項刺激景氣的方案還言之過早。但是在是否挹注更多資金給世界銀行,大家的意見分歧,更不用說在討論崛起中國家要求更多投票權這件事情上。

這股權力移轉的趨勢,我們也可以從G20峰會漸漸取代G7峰會,成為全球最主要的經貿合作論壇這件事上看出一點端倪。前者是由有錢的大國與崛起中的發展中國家共同組成,而後者則是有錢國家才可加入的有錢人俱樂部。事實上,本次大會討論的投票權移轉問題,就是依循上個月底結束的G20峰會產生的共識而來。

國際組織中的權力開始移轉,也暗示有錢國家的影響力已經不像以前那麼強大,同時開始崛起的發展中國家則希望在國際上擁有更多發言權。

根據統計資料,現階段IMF的投票權分配已經無法反映全球經濟成長的現況。某些有錢國家獲得了高於本身貢獻的代表性,而部分發展中國家則嚴重被低估,比方說中國與印度。2008年的全球生產毛額,中國佔了全球的11.3%,卻只在IMF獲得3.1%的投票權。而印度貢獻了全球GDP的4.9%,但他在IMF的投票權只有1.9%。他們將矛頭指向歐洲國家,希望他們能夠交出至少5%的投票權,轉移給他們。

既得利益者

由強國所主導的國際組織,其運作通常也需合乎他們自身的利益,也唯有如此才能成功推動該組織的運作。 所以,當新興發展中國家的力量開始崛起時,這些既得利益者也不願意放棄手中握有的特權。

以聯合國為例,安理會的絕對否決權的大國一致原則,與聯合國大會票票等值的民主運作原則顯然產生許多衝突。當初這種雙軌設計,是為了確保大國加入的意願而使組織具有實質影響力,同時有廣泛會員凸顯其代表性。如今舊時代的秩序開始受到新秩序的挑戰,過去幾年關於聯合國改革的議題也時常成為國際焦點。回到IMF本身,隨著全球經濟實力的消長,開發中國家應該獲得更多代表權,並共同決定世界發展的方向,而非仍舊全由開發中國家所主導。

因此,如何調和這些崛起中國家的需求與強權的利益,將會是這些國際組織要面對的主要挑戰。

沒有留言:

張貼留言